Analyst: Bitcoin Targets $60K, Likely Has Further Room to Rise

Cryptocurrency investment firm Ryze Labs said the key variable for risky assets is the US economy as recession fears persist.

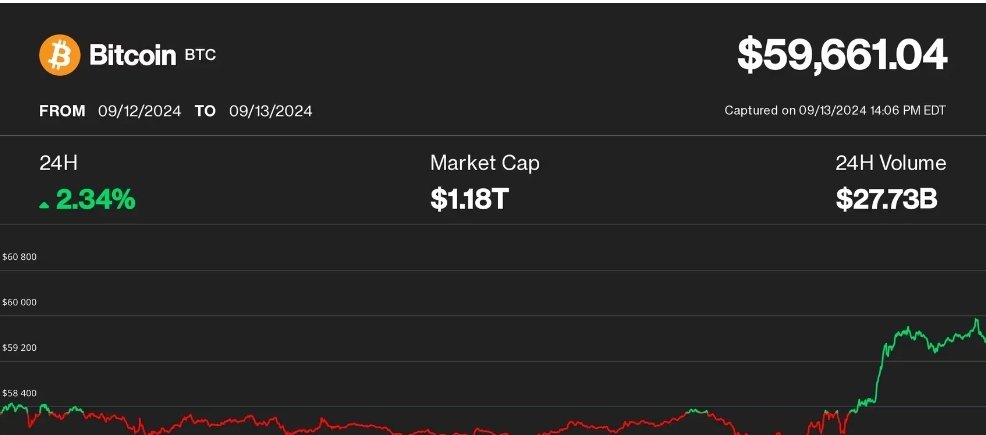

- Bitcoin and Ethereum (ETH) are up 2%-3% in the past 24 hours on a strong day for cryptocurrencies.

- Bitcoin hit its lowest levels last week and is expected to rise further based on the theory of daily cycles, according to chartist Bob Lucas.

- The Federal Reserve is expected to cut interest rates next week, but market participants are divided on the size of the cut.

Cryptocurrencies rallied on Friday as bitcoin (BTC) approached the $60,000 level, supported by strong gains across the board in traditional markets.

Bitcoin fell about 1% to $57,600 earlier in the day after software firm MicroStrategy announced it had purchased 18,300 bitcoins for $1.1 billion.

The largest cryptocurrency quickly recovered from the losses and rose sharply later in the session, up 2.2% over the past 24 hours at $59,700.

Ethereum (ETH) has reclaimed the $2,400 level, up 2.7% over the same period. Cryptocurrency analytics firm IntoTheBlock noted that Ethereum’s revenue from fees has surged nearly 60% in the past week as blockchain activity has picked up.

The price action came as U.S. stocks rose, with the S&P 500 less than 1% away from its July record high just hours before the market closed.

Gold continued to break records, hitting $2,600 an ounce for the first time ever. A weaker U.S. dollar against major currencies also supported gains across asset classes.

Read Also: Japanese company buys over 38 new bitcoins

More Room to Run

Trader and analyst Bob Lucas has suggested that Bitcoin’s rally may have more fuel in the tank based on an analysis of the asset’s daily cycles.

The cycle theory in technical analysis claims that prices move in waves and have a certain periodicity between local highs and lows.

According to a chart shared on X, Bitcoin likely found a local bottom below $53,000 on September 6 and is only on its seventh day in a new cycle.

The previous daily cycle lasted over sixty days and peaked on the 24th, leaving plenty of time for Bitcoin to make new highs before rolling over.

“These cycles have time left and should remain strong until the FOMC meeting,” Lucas said.

The main event to watch next week will be Wednesday’s FOMC meeting, which will almost certainly mark the Fed’s first rate cut since 2020.

Observers remain divided on the size of the cut, with odds roughly evenly split between a 25 basis point cut and a larger 50 basis point cut, according to the CME FedWatch tool.

Read Also: Bitcoin, Ethereum, and XRP: Weekly Summary

Despite the potential for monetary easing, which would theoretically be beneficial for risk assets, ongoing fears of an impending recession are weighing on the market, cryptocurrency investment firm Ryze Labs said in a report released Friday.

“The key variable here is the state of the U.S. economy,” the report said. “If the U.S. economy remains resilient and avoids a recession, risk assets are likely to continue their upward trajectory. If not, we are in for a bumpy ride.”

Leave a Reply